Why Has Stripe Set Up A Direct Debit

Ever wondered why that handy service you use suddenly started taking payments automatically from your bank account? Well, today we're diving into a topic that's become surprisingly commonplace and, dare we say, even a little exciting: Stripe and Direct Debits. It might sound a bit technical, but trust us, understanding this is like unlocking a little secret to making your financial life just a tad smoother. It's all about making payments easier for everyone involved!

So, what's the big deal? Think of Stripe as a super-efficient online payment processor. They help businesses get paid. Now, they've added Direct Debit to their toolkit. This means that instead of you actively logging in each month to pay for your gym membership, streaming service, or that subscription box you adore, the money can be automatically pulled from your bank account on a set date. It’s all about convenience, really!

For beginners in the world of online services, this is a dream. No more forgetting to pay bills and incurring late fees! It means you can sign up for something and then forget about it, knowing your payments will be handled. For families, imagine streamlining all those recurring household bills. From school lunches to utility payments, setting up a Direct Debit can free up mental bandwidth that’s often stretched thin. And for the dedicated hobbyists who subscribe to specialized magazines, software, or craft supplies, it’s another way to ensure you never miss out on your passion.

Let’s look at some simple examples. You might have a favorite yoga studio that offers a monthly unlimited pass. They could use Stripe to set up a Direct Debit so you pay automatically. Or perhaps that online course you’re taking to learn a new skill has monthly installments – Stripe Direct Debit makes that a breeze. It’s not just for big companies either; even small online shops or independent creators can leverage this to offer their customers a more seamless payment experience.

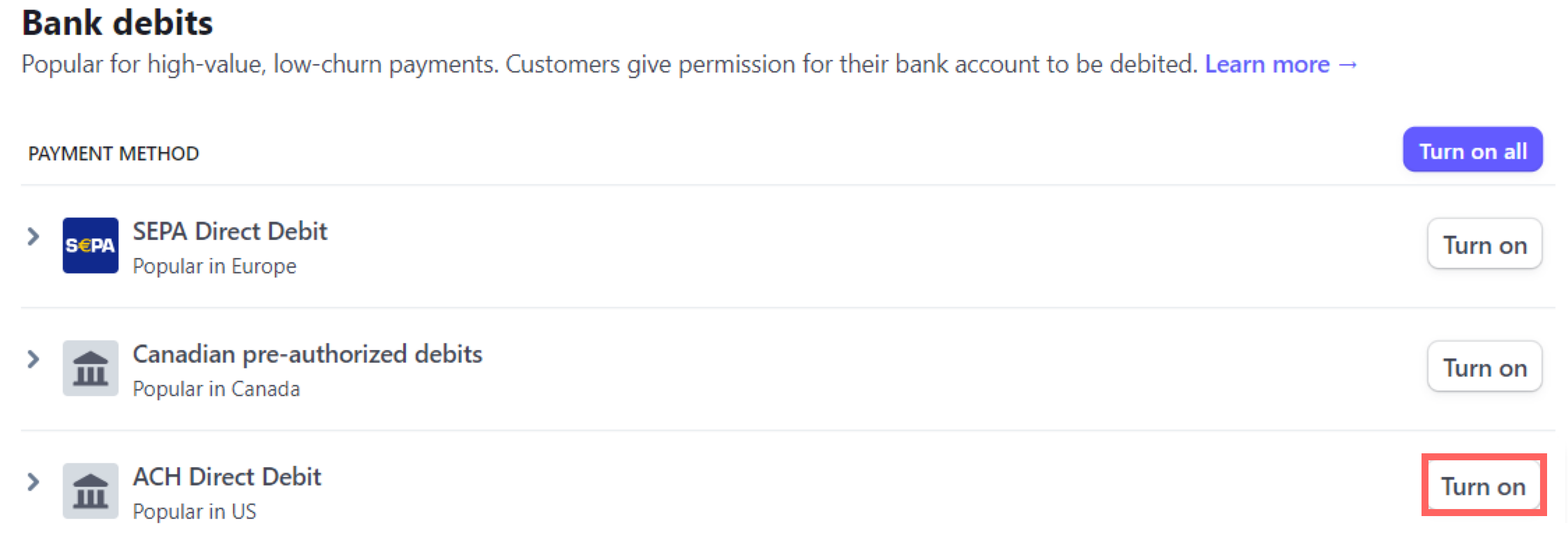

Getting started is surprisingly easy. If you're a customer signing up for a service that offers Stripe Direct Debit, you’ll typically be guided through a simple authorization process when you first subscribe. You’ll need your bank account details, and you’ll give the company permission to take payments. It’s usually a few clicks, and then you're all set! If you're a business owner thinking about this, Stripe's platform makes it straightforward to integrate Direct Debit into your checkout process. Think of it as an upgrade for your payment options.

In a nutshell, Stripe's move into Direct Debit is all about making payments more hassle-free for both businesses and consumers. It's a smart step towards a world where we can focus more on enjoying our services and less on remembering to pay for them. It’s a little piece of financial magic that makes everyday life just a bit more convenient and, dare we say, even enjoyable!