What Type Of Contract Is Credit Sale

So, I was at this ridiculously cute little antique shop last weekend, you know, the kind where you can practically smell the history clinging to everything? I’d been eyeing this gorgeous, slightly chipped porcelain teacup for ages. It was perfect, seriously, like it had whispered my name from across the room. The shop owner, a lovely lady with an equally lovely cat napping on the counter, told me the price. My jaw did that little internal drop thing. It was more than I’d planned for a teacup, even a historic teacup. But then she smiled, a little twinkle in her eye, and said, "Don't worry, dear, we offer a little something called a 'credit sale'."

My ears perked up. "A credit sale?" I asked, picturing myself walking out with the teacup and a brand new credit score. She chuckled. "Not quite like that, but close! You can take it home today and pay me back in installments." And just like that, the mystery of the "credit sale" was unveiled, at least in its most basic, charming, antique-shop form. It got me thinking, though. What exactly is a credit sale, and how does it differ from, say, just… buying something?

It’s funny, isn't it? We hear terms like "credit sale" thrown around, and sometimes it feels like you need a secret handshake to understand them. But at its core, it's all about a very fundamental concept: trust. And maybe a little bit of clever structuring to make sure everyone gets what they want without anyone ending up with buyer’s remorse and an empty wallet.

The Heart of the Matter: When "Now" Meets "Later"

Okay, so let’s ditch the teacup for a second and get a bit more formal, but still keep it breezy, alright? A credit sale, in its most general and widely understood sense, is a contract where a seller agrees to transfer ownership of goods or services to a buyer immediately, but the buyer agrees to pay for them at a later date, or in a series of payments over time. See? It's that simple, and yet so incredibly powerful.

Think about it. Without credit sales, a lot of our modern economy would just… sputter. Imagine trying to buy a house or a car if you had to plunk down the entire lump sum in cash right then and there. Most of us would still be dreaming about that cozy cottage or that sleek sedan. Credit sales are the engines that allow us to acquire things we need and want, even when our bank accounts aren't quite ready for the hit.

The "contract" part is crucial here. It's not just a casual "I'll get you back" situation. This is a legally binding agreement. Both parties have obligations, and there are consequences if those obligations aren't met. It’s like that teacup owner and I – she trusted me to pay, and I agreed to a schedule. If I hadn't, well, she'd have her teacup back, and I'd be teacup-less and probably a bit embarrassed.

Breaking Down the "Contract" Bits

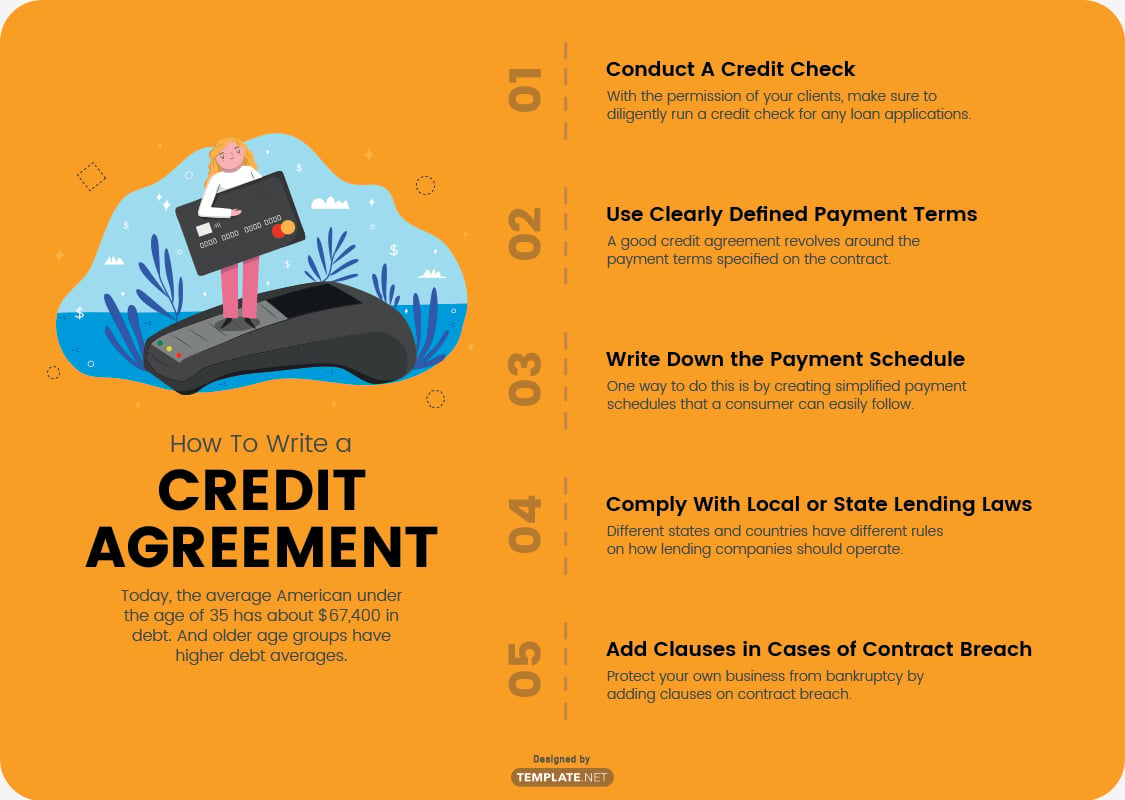

So, what makes a credit sale a contract? We’re talking about the good old elements of a contract, the things you learned about in, like, high school civics class (or maybe you blissfully skipped that part, no judgment here!).

- Offer: The seller offers to sell the goods or services on credit. This is like my antique shop lady saying, "You can take it now and pay later."

- Acceptance: The buyer agrees to the terms of the sale, including the credit arrangement. I’m nodding enthusiastically and saying, "Yes, please!"

- Consideration: This is the exchange of value. The buyer gets the goods (the teacup!), and the seller gets the promise of future payment. It’s the quid pro quo, the give and take.

- Legality: The sale must be for a legal purpose. You can't enter into a credit sale contract for, you know, illegal stuff. That’s a whole other can of worms.

- Capacity: Both parties must be legally capable of entering into a contract. This means they're of sound mind and of legal age. No selling your neighbor's cat on credit if you’re still in grade school.

When these elements are present, and the agreement outlines the terms of payment (how much, when, interest rates if any), you've got yourself a bona fide credit sale contract. Pretty neat, right?

The Many Flavors of Credit Sales

Now, this is where it gets interesting. "Credit sale" is kind of a broad umbrella term. Underneath it, there are a whole bunch of specific types of arrangements that all fall under this general idea of buying now and paying later. It's like how "dessert" can mean anything from a delicate crème brûlée to a gigantic slice of chocolate cake. Both are desserts, but they're definitely different experiences!

1. Installment Sales: The Classic Pay-As-You-Go

This is probably what most people picture when they think of a credit sale. An installment sale is when the buyer agrees to pay for the goods or services in a series of fixed, regular payments over a specified period. Think of buying a new sofa, a TV, or, yes, even that slightly more expensive teacup from a store that offers financing. Each payment usually includes a portion of the principal amount borrowed and potentially some interest.

This is super common for larger purchases. You put down a small deposit (or sometimes nothing at all!), and then you have a clear repayment schedule. The seller gets their money spread out, which is often easier for them too, rather than waiting for one massive check. And you, the buyer, get to enjoy your new acquisition right away. It’s a win-win, provided you’re diligent with those payments!

What’s cool about installment sales is that the seller often retains a security interest in the goods until the final payment is made. This means if you really stop paying, they can repossess the item. A bit scary to think about, but it’s what gives the seller the confidence to extend credit in the first place. It’s like a safety net for their business.

2. Conditional Sales: Ownership on Hold

This one is a bit of a twist. In a conditional sale, the seller also agrees to transfer possession of the goods immediately, but crucially, ownership (or title) of the goods doesn't pass to the buyer until the full purchase price has been paid. The sale is conditional upon complete payment.

This is a little different from a standard installment sale where ownership might pass sooner. Here, the seller retains title as extra security. It’s a stronger hold for the seller, making it a less risky proposition for them if the buyer defaults. For the buyer, it means they don't legally own the item until they've paid it off, even if they've had it in their living room for months.

Imagine buying a brand-new car. In many cases, the dealership might hold the title until you've made all your car payments. If something goes wrong and you can’t pay, they have a clearer claim to getting their vehicle back because they technically never fully relinquished ownership. It’s a bit like a lease with an option to buy, but it’s classified as a sale.

3. Consignment Sales: The Middleman's Deal

Okay, this one is a bit of a tangential cousin, but it often involves credit in some form. In a consignment sale, a seller (the consignor) delivers goods to another party (the consignee) who agrees to sell them. The consignee doesn't buy the goods upfront; they only pay the consignor after they've sold the goods to an end buyer. The consignee often takes a commission for their selling services.

While the end transaction with the ultimate buyer is usually a cash or standard credit sale, the relationship between the consignor and consignee is built on deferred payment. The consignee essentially has the goods on credit from the consignor until they are sold. Think of those cute independent boutiques that sell clothing from local designers. The boutique doesn't buy all the inventory outright; they take it on consignment. This allows the designer to get their work out there without a huge upfront risk and allows the boutique to offer a curated selection without massive inventory costs.

It’s a fascinating model that leverages trust and a shared goal: getting those goods into the hands of happy customers! The payment to the consignor is contingent on a sale, which is a form of credit, albeit a very specific one.

4. Layaway Plans: The Old-School Saver

This is a classic, especially for holiday shopping before credit cards were everywhere. A layaway plan allows a buyer to select an item and pay for it in installments over time, but here’s the kicker: the seller holds onto the goods until the final payment is made. You don't get to take it home until it's fully paid for.

It’s like a savings account for an item. You’re essentially saving up for something while securing its price. The benefit is that you avoid interest charges and the temptation to spend the money elsewhere. The drawback? You don't get to enjoy your purchase until you've completed the payments. It's the ultimate exercise in patience! My grandma used to swear by layaway. She said it taught discipline and ensured she only bought things she truly wanted and could afford over time.

While technically a "sale" contract, the immediate transfer of possession is missing. So, it’s a credit sale in the sense of deferred payment for goods, but without the immediate gratification. It’s a great option for those who want to avoid debt and the fees associated with it.

Why So Many Names? It's All About the Details!

You might be thinking, "Okay, so if they're all about paying later, why all the different names?" Well, as you’ve seen, the devil is truly in the details. The specific terms, the point at which ownership transfers, and the nature of the seller's security interest all differentiate these types of credit sales.

The choice of contract type often depends on the value of the goods, the seller's risk tolerance, and the buyer's needs and creditworthiness. A high-value item might involve a conditional sale with the seller retaining title, while a lower-value item might be sold on a simple installment plan where title passes more readily. And, of course, the antique shop owner’s charming offer for my teacup was a very informal, direct installment plan, likely based on her personal trust in me as a customer!

The "Why" Behind the Credit

Why do sellers offer credit sales in the first place? It's not just about being nice! For sellers, offering credit can:

- Increase Sales Volume: Making items accessible to a wider range of buyers who can't pay upfront means more sales overall.

- Attract More Customers: Especially for larger ticket items, credit is often a deciding factor for buyers.

- Build Customer Loyalty: A good credit experience can bring customers back for future purchases.

- Compete Effectively: If competitors offer credit, you likely need to as well.

And for buyers? The benefits are pretty obvious:

- Immediate Gratification: Get what you need or want now.

- Affordability: Break down large costs into manageable payments.

- Building Credit History: Responsible use of credit can improve your credit score, opening doors to even better financial opportunities down the line.

Of course, with credit comes responsibility. For buyers, it means managing payments, understanding interest rates, and avoiding overspending. For sellers, it means assessing risk, managing defaults, and ensuring legal compliance. It’s a dance, really, and when done right, it benefits everyone.

So, the next time you hear "credit sale," you'll know it's not some scary, complex financial jargon. It's simply an agreement that allows us to enjoy the things we need and desire today, with the promise of paying for them tomorrow. Whether it’s a fancy teacup, a new car, or a much-needed appliance, credit sales are the silent facilitators of many of our modern purchases. And that, my friends, is a pretty sweet deal.