What Time Does A Direct Debit Go Out

Ah, the direct debit. It's like that trusty friend who always remembers your birthday, except instead of a card, they whisk away money for your bills. You might think it's a bit mysterious, a shadowy operation happening in the digital ether. But let's pull back the curtain, shall we? It’s not as complicated as rocket science, and frankly, it’s a lot more heartwarming.

Think of your direct debit as a little digital elf, working tirelessly behind the scenes. This elf has a very important job: making sure your bills get paid on time, every time. It’s the reason your lights stay on and your streaming service keeps playing those endless reruns you secretly love.

So, what time does this magical money-moving elf actually do its thing? Well, it's not quite as simple as saying "around lunchtime" or "just before sunset." The timing can be a little bit of a surprise, a little wink from the universe of finance.

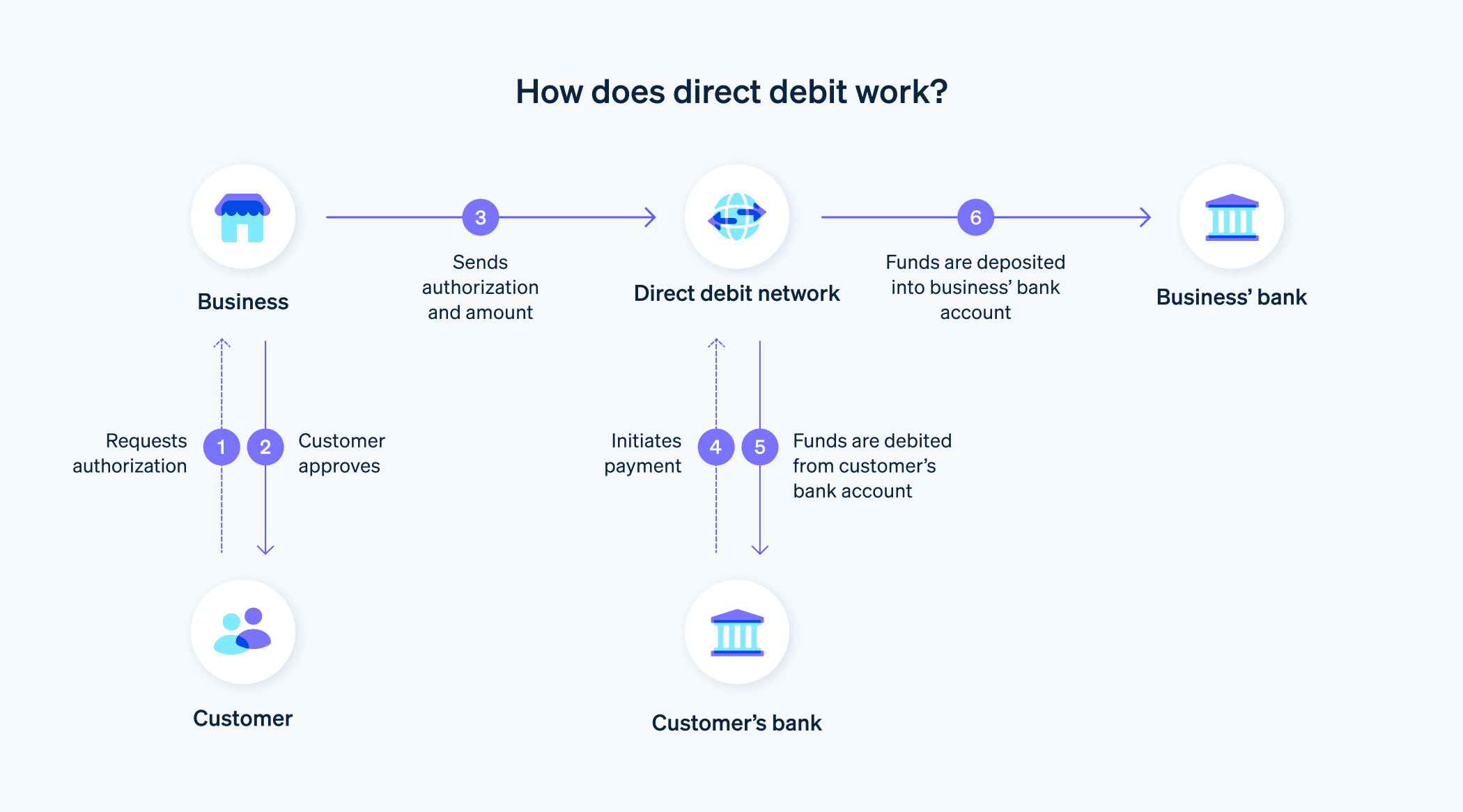

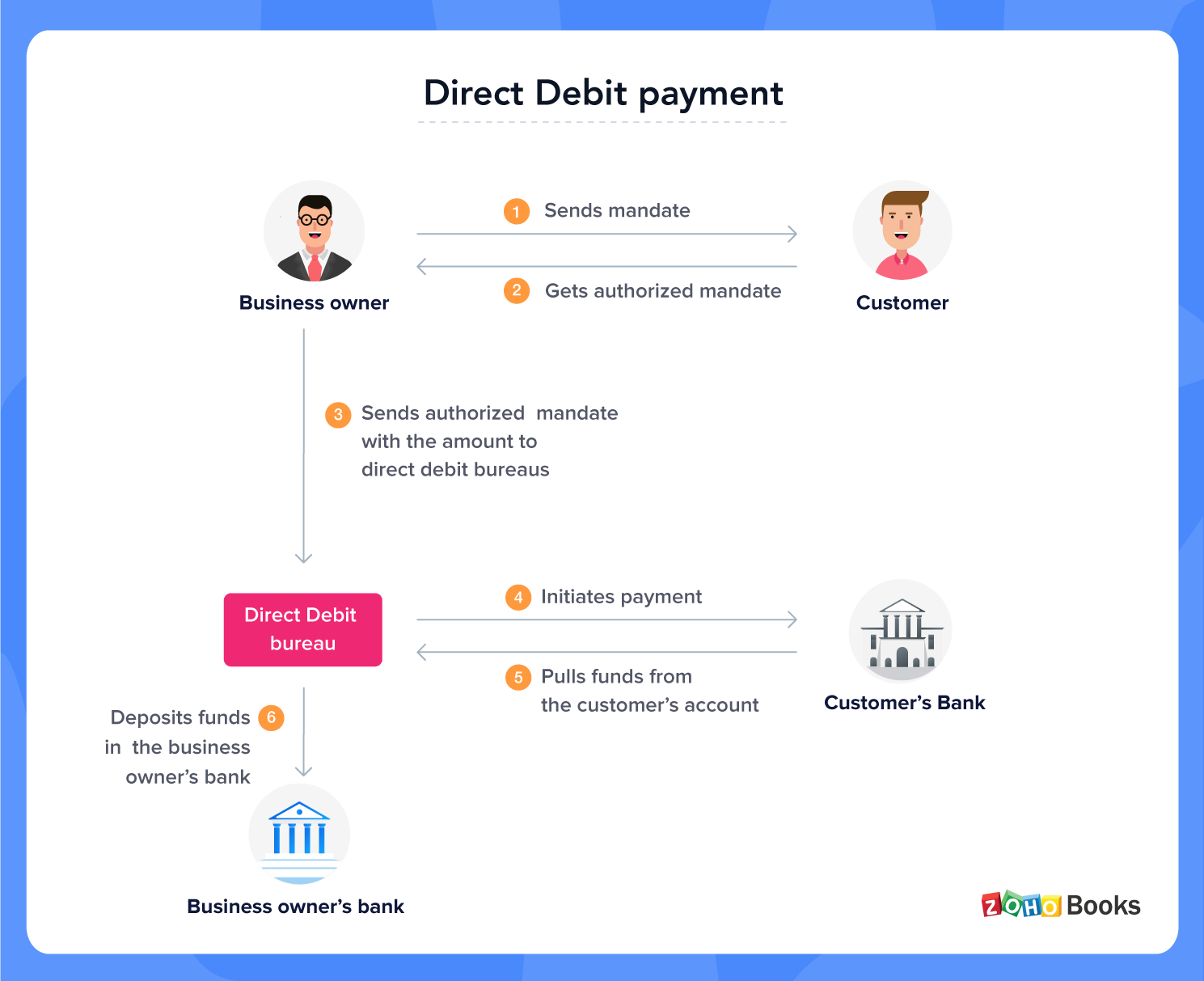

Generally, your direct debit instruction tells your bank when to let the money go. This instruction is set up by the company you owe money to, like your phone provider or your gym. They’re the ones who orchestrate the whole dance.

The key thing to remember is that it's usually a specific date, not a specific time in the strictest sense. So, if your phone bill is due on the 15th, the direct debit will try to happen on the 15th. It's like setting an alarm, but for your finances.

But here’s where it gets interesting, and a little bit like a treasure hunt. While the instruction is for a date, the actual process of money moving can happen at different times throughout that day. It's not a single, synchronized 'poof' of cash.

Imagine a river. The river flows all day, right? Similarly, the money transfers for direct debits can be happening at various points. Your bank and the recipient's bank are constantly communicating, like busy bees in a hive.

So, if you check your bank balance first thing in the morning, the direct debit might not have landed yet. It could be a mid-morning event, or perhaps an afternoon affair. It’s a little bit of financial suspense!

Sometimes, if a bill is due on a weekend or a public holiday, the direct debit will be moved to the next working day. This is a thoughtful little perk, so you don't have to worry about missing a payment because you were busy enjoying a long weekend.

Think of it like this: your direct debit wants to be a good citizen. It respects the calendar and avoids causing you any unnecessary stress. It’s trying its best to be as smooth as possible.

The company that is receiving the money will have a specific window in which they expect to receive it. They’ll have their own systems humming along, ready to accept payments. So, it’s not just random; there’s a whole network of coordination.

One of the most heartwarming aspects of direct debits is the peace of mind they offer. For busy parents, for students juggling studies, or for anyone who’s ever forgotten to pay a bill and felt that pang of panic, direct debits are a silent hero.

They eliminate the need for manual payments, which can be prone to human error. No more scribbling down dates or fumbling for your card details. It's a little piece of automation that makes life just that bit easier.

Consider the sheer volume of these transactions happening every single day. Millions of direct debits are processed, each one a testament to trust and efficiency between individuals and businesses.

It’s a system built on the promise that you’ll pay for the services you use, and the companies will provide those services without constant chasing. It’s a quiet pact, a financial handshake.

Now, let's talk about that feeling when you check your account and see a payment has gone out. For some, it might be a moment of mild annoyance. "Oh, there goes my hard-earned cash!"

But for many, especially those who’ve set up direct debits for things like their mortgage or rent, it’s a moment of relief. It’s the knowledge that a significant responsibility has been met. It’s a step towards stability.

It’s like having a tiny financial butler who discreetly handles your most important outgoings. You don’t have to be there to supervise; the butler just gets on with it.

The technology behind it is surprisingly sophisticated, but for us, the end-users, it's beautifully simple. You authorize it once, and then it just... works.

There are also "same-day" and "next-day" clearing systems. This is where the actual timing can subtly vary. If a payment is processed quickly, it might be gone from your account earlier in the day.

If it’s part of a larger batch processing or uses a slightly different route, it might appear later. It’s like different delivery services – some are express, some are standard.

The most reliable way to know when your direct debit is likely to go out is to look at the date specified on your bill or in your agreement. That date is your anchor.

Most banks will show pending transactions. So, if you’re a bit of a worrier, you can often see the direct debit as "pending" in your account before it officially clears. It's like a preview of your financial day.

Think of your direct debit as a well-trained pet. It knows when it's time for its walk (its payment window) and it goes about its business without fuss. It’s predictable in its unpredictability within that defined window.

And let’s not forget the companies themselves. For them, direct debits are a lifesaver. It means they can forecast their income much more accurately, plan their operations, and keep their own businesses running smoothly.

It's the unsung hero of cash flow management. It’s the reason your favorite coffee shop can afford to keep brewing your morning fix.

So, while there isn’t a precise clock-in time for every single direct debit, the system is designed for efficiency and reliability. It’s a complex ballet of zeros and ones, orchestrated for our convenience.

The heartwarming part? It’s the collective effort. It’s millions of people and businesses trusting a system that, for the most part, quietly gets the job done. It’s a testament to modern living and the invisible threads that hold our economy together.

The next time a direct debit whizzes out of your account, give it a little nod of appreciation. It’s not just money disappearing; it’s a little piece of financial magic, ensuring the smooth running of your life and the services you depend on. It’s a quiet promise kept, a small victory of order in a sometimes chaotic world.

And who knows? Perhaps your direct debit elf is humming a cheerful tune as it works, ensuring your world keeps turning, one bill at a time. It's a surprisingly cozy thought for such a financial transaction, wouldn't you agree?