What Makes Your Credit Score Go Down

Hey there, credit score detectives! Ever wonder why that little number, your credit score, sometimes takes a nosedive like a confused pigeon? It’s a bit like a popularity contest for your financial habits, and sometimes, even the best of us can accidentally spill the beans and lose some points. Don't worry, it's not the end of the world, but it's definitely worth understanding the secret handshake to keep it looking good.

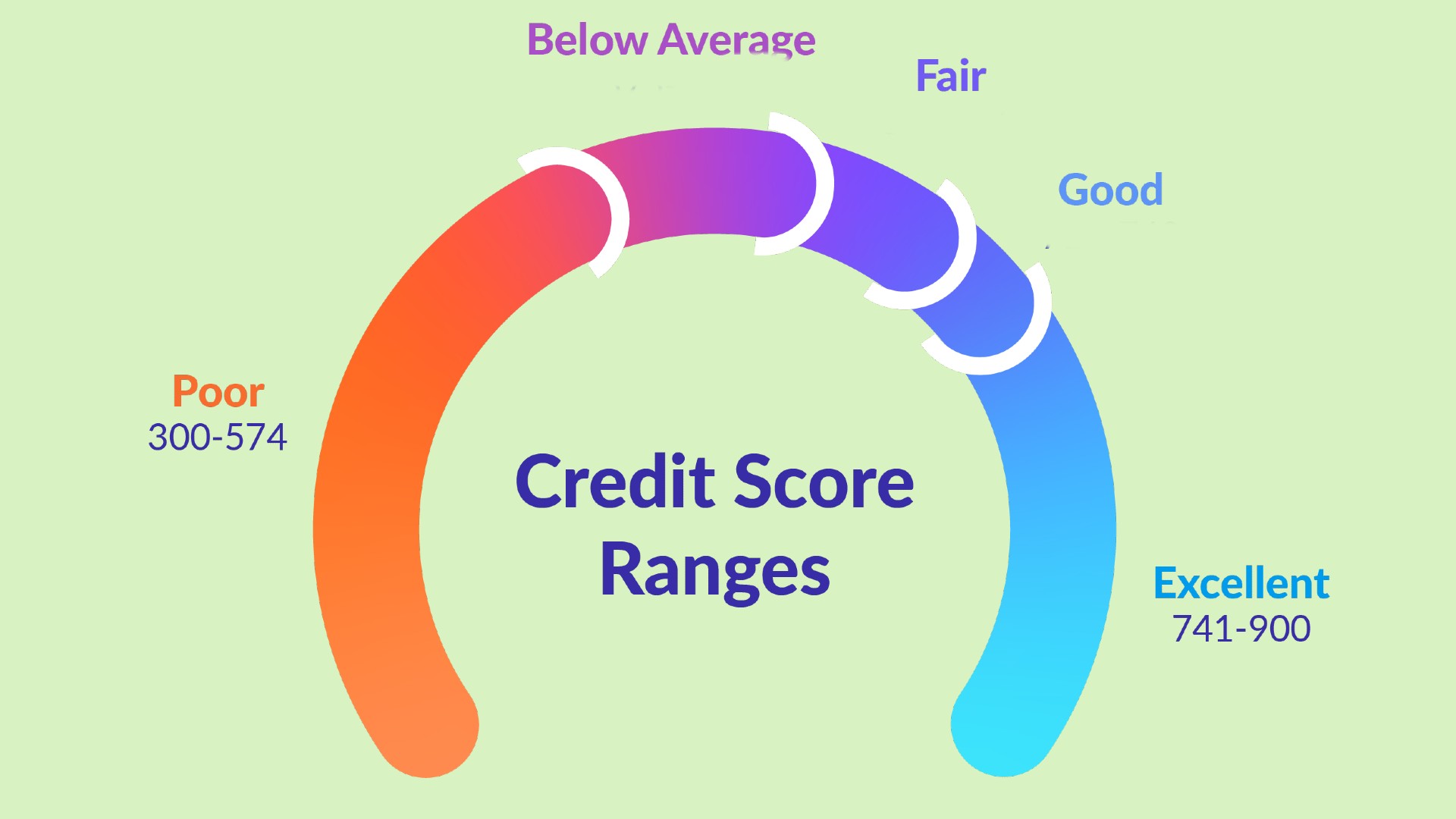

Think of your credit score as your financial report card. It tells lenders how reliable you are when it comes to borrowing money. A good score means you're like the star student who always pays back their lunch money. A not-so-great score might make them a little hesitant, like a teacher who remembers you borrowed their favorite pen and never returned it.

So, what are the sneaky ways your score can go down? Let's peek behind the curtain, shall we? It’s not always about grand financial gestures. Sometimes, it’s the little things, the everyday occurrences that can have a surprising impact. We're talking about everyday decisions that can ripple through your financial life in unexpected ways.

The Case of the Missing Payment

This is probably the biggest culprit. Imagine you have a really important date, and you accidentally show up an hour late. Not ideal, right? Well, missing a credit card payment is kind of like that, but for your money relationships. Lenders see it as a sign that you might be a bit unreliable.

Even just one late payment can send your score tumbling. It’s like a tiny oopsie that gets amplified. The longer you’re late, the bigger the ding. So, setting up reminders or even automatic payments is like having a personal assistant for your finances, ensuring you never miss that crucial appointment.

It's not about being perfect, but about being consistent. Think of it as nurturing a friendship. You wouldn't ghost your best friend, would you? Your credit score feels the same way about your payment history.

Maxing Out Your Credit Cards: The "Overwhelmed" Friend

Imagine your credit card is a friendship bracelet. You wouldn't load it up with so many charms that it’s about to break, would you? When you use up most of your available credit, it's called a high credit utilization ratio. Lenders see this as a sign you might be in a tight spot financially, relying heavily on borrowed money.

Think of it like this: if you have $100 to spend, and you spend $95 of it, you’re looking pretty close to the edge. But if you spend $10, you look like you’re cruising along just fine. Keeping your balances low, ideally below 30% of your credit limit, is like wearing that friendship bracelet with just a few well-chosen charms. It shows you’re in control and not overextended.

This is a surprisingly easy one to manage. Even if you have a big purchase, paying it down quickly can make a world of difference. It’s like offering your friend a helping hand to ease their load. Your credit score will thank you for it!

Closing Old Credit Accounts: The "Forgetting the Past" Folly

Sometimes, we think closing an old credit card is like decluttering our wallet. Out with the old, in with the new! But for your credit score, it can be a bit of a misstep. These old accounts, even if you don't use them, can be like loyal friends who’ve been with you through thick and thin.

When you close an account, you lose that positive payment history associated with it. Plus, it can lower your overall available credit, which, as we just discussed, can increase your credit utilization ratio. It’s like telling your oldest friend you don’t need them anymore, and then realizing you have fewer people to rely on.

It’s often better to keep those older, well-managed accounts open. Even if you just use them for a small, recurring purchase once in a while and pay it off immediately, it keeps them active and contributing to your history. Think of it as a quiet nod to your past, keeping those reliable friendships intact.

Opening Too Many New Accounts at Once: The "Scatterbrained Student"

Ever feel like you're trying to juggle too many balls at once? That’s what opening several credit accounts in a short period can look like to your credit score. Each time you apply for new credit, it results in a hard inquiry on your credit report. Too many of these can make lenders a little nervous.

It's like showing up at a party and immediately asking everyone to borrow their car. It might seem a little desperate, and lenders might wonder if you're trying to get money because you're in trouble. A few inquiries here and there are normal, but a barrage can raise a red flag. We're talking about a bunch of applications all within a few weeks or months.

This one is about pacing yourself. Think of it as a nice, leisurely stroll rather than a frantic sprint. If you need new credit, space out your applications. It allows your credit report to breathe and the inquiries to have less impact.

Errors on Your Credit Report: The "Misunderstood Story"

Sometimes, your credit score can take a hit because of something that's just plain wrong. Imagine your school transcript has a grade for a class you never took! That’s what an error on your credit report can feel like. These mistakes can happen, and they can unfairly drag your score down.

These errors can range from incorrect late payments to accounts you don't recognize. It's like a whispered rumor that gets distorted and ends up hurting someone’s reputation. Fortunately, these are usually fixable, but you have to be proactive.

The good news is you have the right to check your credit report regularly. You can get free copies from the major credit bureaus. If you spot something that looks fishy, don't just ignore it. You can dispute it, and once it's corrected, your score can bounce back like a happy puppy!

Not Having Enough Credit History: The "New Kid on the Block"

This might sound counterintuitive, but sometimes, not having enough credit can also lower your score. If you’re the new kid in town, people don’t have much to go on to know if you’re reliable. Lenders need to see a history of responsible borrowing to trust you.

Without a solid credit history, it’s like trying to build a house on sand. There's not enough foundation for lenders to feel secure. This is especially common for young adults or those who have primarily used cash for all their transactions.

The heartwarming part is that building credit is a journey. Starting with a secured credit card or becoming an authorized user on a trusted family member's card can be great first steps. It’s like making new friends and showing them you’re a good person to know!

So, there you have it! Your credit score isn't some mystical entity; it's a reflection of your financial habits. By understanding these common pitfalls, you can navigate the world of credit with more confidence and keep that important number looking as good as you feel after a great cup of coffee. Happy crediting!