What Is A Default On A Credit Report

Hey there, savvy navigators of modern life! Ever find yourself scrolling through your credit report, maybe after a particularly ambitious online shopping spree or while dreaming about that sweet, sweet Tesla you might get one day? If so, you might have stumbled across a term that sounds a bit... final. We're talking about the dreaded "default." It’s a word that can make even the most chill person feel a twinge of anxiety, right? Like when your favorite cafe suddenly decides to close its doors for good. Totally not the vibe we're going for. But fear not! Think of this as your friendly, no-judgment guide to understanding what exactly a default is and, more importantly, how to keep it from crashing your financial party.

So, what's the deal with defaults? At its core, a default is simply a failure to fulfill an obligation. In the world of credit, this usually means you haven't made your scheduled payments on a loan or credit account. It's like agreeing to bring the artisanal cheese platter to a potluck and then completely forgetting. Oops!

When you sign up for a credit card, a mortgage, a car loan, or even some student loans, you're entering into a contract. You promise to pay them back, and they, in turn, trust you to do so. A default happens when that trust is broken because the payments just… stop coming. It's not a pretty picture, and for good reason. Lenders rely on those payments to, you know, keep the lights on and their business running. They’re not running a charity, bless their hearts.

Let's break it down into some common scenarios. Picture this: you have a credit card, and you've been enjoying its perks (hello, 5% back on groceries!). But then life throws a curveball. Maybe your freelance gig dried up faster than a spilled latte on a hot sidewalk, or perhaps an unexpected medical bill landed like a rogue emoji. Whatever the reason, the minimum payment due date comes and goes, and crickets. That's when the gears of default start to turn.

It's not an instant "you're a bad person" situation, though. Lenders typically have a grace period. This is their way of saying, "Hey, we get it, life happens. We'll give you a little breathing room." This grace period can vary, but it's usually around 30 days past your due date. Think of it as the polite reminder knock on your door, not the eviction notice.

However, if you sail past that 30-day mark without making a payment, things start to get serious. This is often when your account is officially considered "delinquent." It’s a step towards default, a little red flag waving frantically. And trust me, those red flags are visible to more than just your friendly neighborhood credit card company.

If delinquency continues, say, for 60 or 90 days, your account is likely to be officially marked as a default on your credit report. This isn't just a temporary stain; it's a significant mark that can linger for years. Imagine it like a really embarrassing outfit you wore to a party – everyone saw it, and it’s going to be part of the story for a while. And unlike that outfit, this one affects your ability to get approved for future loans, rent an apartment, or even sometimes get a job.

The Not-So-Glamorous Consequences of Default

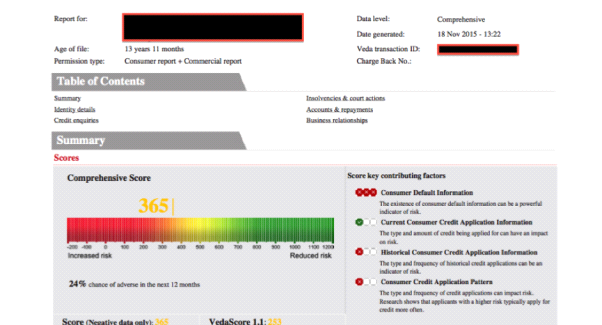

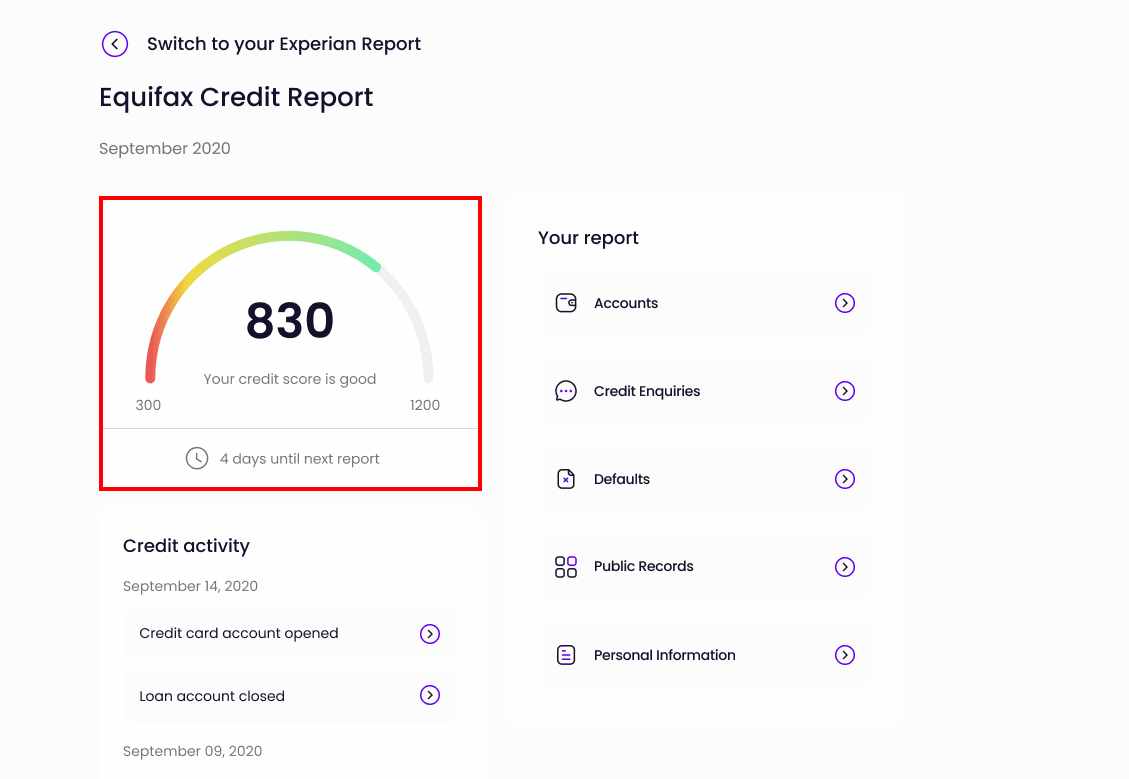

Okay, let's talk about the ripple effects. What happens when your credit report gets that big, bold "DEFAULT" stamp? It’s not exactly the highlight reel of your financial journey. For starters, your credit score, that all-important three-digit number that can feel more mystical than a unicorn sighting, takes a massive hit. We're talking a plunge that would make a rollercoaster look tame.

Why does your score drop so drastically? Because a default signals to future lenders that you are a higher risk. They see it and think, "Hmm, this person didn't pay their bills before. What's to say they'll pay our bills?" It’s a logical, albeit harsh, assessment from their perspective.

This lower credit score can make it incredibly difficult to do basic adulting. Want to buy a house? Good luck getting a mortgage with favorable interest rates. Thinking about a new car? Expect higher monthly payments or potentially no approval at all. Even renting an apartment in some competitive markets can become a challenge, as landlords often check credit reports to gauge the reliability of potential tenants. It’s like trying to get into an exclusive club with the wrong kind of ticket.

And let's not forget the interest rates. When you do manage to get approved for credit after a default, those interest rates will likely be sky-high. It’s the lender’s way of compensating themselves for the perceived risk. This means you end up paying significantly more for everything over time. It’s like paying extra for premium seating when you just wanted a regular ticket.

Beyond the credit score, there's also the possibility of your account being sent to collections. This is where a third-party agency tries to recover the money you owe. Their methods can range from polite phone calls to more aggressive tactics, which can be incredibly stressful. Think of it as your financial oopsie being handed over to the debt recovery squad. Not exactly a spa day.

In some extreme cases, especially with secured loans like mortgages, defaulting can lead to foreclosure, meaning the lender can take possession of your property. For car loans, it means the repossession of your vehicle. These are the ultimate consequences, the financial equivalent of losing your keys and your car in one go.

Navigating the Default Landscape: Prevention is Key

Okay, deep breaths. We've painted a slightly grim picture, but the good news is that defaults are usually preventable. It’s all about being proactive and having a game plan. Think of it like being prepared for a sudden downpour – you wouldn't leave home without an umbrella, right? Your financial life deserves the same level of preparedness.

The absolute number one tip is to stay organized with your payments. Seriously. Mark due dates on your calendar, set up automatic payments (if you’re comfortable with it), or create a dedicated spreadsheet. Whatever works for you to ensure those payments are made on time, every time. It’s like having a personal financial assistant, minus the coffee runs.

If you foresee a potential struggle, don't wait until it's too late. If you know you’re going to miss a payment, or even just be a few days late, reach out to your lender before the due date. They are often more willing to work with you if you’re upfront. They might offer a payment plan, a temporary deferral, or a modified payment schedule. It’s like telling the chef you have an allergy before they start cooking. Much easier to accommodate!

Consider building an emergency fund. This is your financial safety net. Aim to have enough saved to cover three to six months of essential living expenses. This fund can be a lifesaver when unexpected expenses pop up, preventing you from having to dip into your credit or skip payments. It's your personal "get out of jail free" card for financial emergencies.

Review your budget regularly. Are you spending more than you earn? Are there areas where you can cut back? Understanding your cash flow is crucial. Sometimes, a few small adjustments can free up enough money to cover your obligations. Think of it as decluttering your financial house. You’d be surprised what you find when you look closely.

Avoid taking on more debt than you can handle. It sounds obvious, but in the age of instant credit and buy-now-pay-later schemes, it’s easy to get carried away. Before you sign on the dotted line for a new loan or credit card, ask yourself: can I realistically afford the monthly payments, including interest? It’s the financial equivalent of resisting that second slice of cake when you’re already full.

Fun Facts and Cultural Quirks of Credit

Did you know that the concept of credit scoring as we know it really took off in the early 20th century? Before that, trust was more personal. If your neighbor vouched for you, you were golden. It’s a far cry from today's complex algorithms!

The term "default" itself has interesting roots. It comes from the Latin word "diffallere," meaning "to fail." It's been used in legal and financial contexts for centuries, reminding us that promises matter.

In some cultures, there’s a much stronger emphasis on communal support and informal lending within families or close-knit communities. While this can be wonderful, it can also mean that formal credit systems might be less developed or understood. It’s a different approach to financial responsibility.

Ever seen those movies where the shady character says "I'll make you a deal you can't refuse"? Well, in the financial world, failing to uphold your end of the deal has consequences, and they’re usually far less cinematic. No exploding cigars here, just significantly higher interest rates.

The advent of digital finance and cryptocurrencies has introduced new forms of credit and potential for defaults. While exciting, it also means we need to be even more mindful of the underlying principles of borrowing and repayment. The technology changes, but the financial gravity remains.

Dealing with a Default (If it Happens)

Okay, so what if, despite your best efforts, a default has happened? It's not the end of the world, but it is a serious situation that requires attention. The first step is to understand the specifics of the default: which account, how much is owed, and what are the terms of repayment if a collection agency is involved.

Get your credit report. You’re entitled to a free report from each of the three major credit bureaus annually (Equifax, Experian, and TransUnion). Review it carefully for accuracy. If you find errors, dispute them immediately. Sometimes, a mistaken entry can be removed.

Contact the lender or collection agency. Be prepared to negotiate a payment plan. You might not get the exact terms you want, but showing willingness to pay can go a long way. Remember, they want their money, and you want to get back on track. It's a negotiation, like haggling at a flea market, but with higher stakes.

Consider credit counseling. Non-profit credit counseling agencies can provide valuable advice and help you create a debt management plan. They can negotiate with creditors on your behalf and help you get your finances in order. It’s like having a financial coach in your corner.

Rebuilding your credit takes time. After a default, you'll need to demonstrate a consistent history of responsible credit behavior. This might involve getting a secured credit card (where you put down a deposit) or becoming an authorized user on someone else's credit card (with their permission and trust, of course). Consistently making small payments and paying them off on time will slowly but surely help improve your score.

A Moment to Reflect

Thinking about defaults, and the careful dance of managing credit, can feel a bit like navigating a busy city street. There are clear rules, potential pitfalls, and the need for constant awareness. We want to get where we’re going smoothly, enjoy the sights, and arrive without a scratch. A default is like getting caught in a traffic jam that makes you miss an important appointment. It’s frustrating, it throws off your entire day (or year!), and it makes you re-evaluate your route.

Ultimately, understanding what a default is isn't about dwelling on the negative. It’s about empowerment. It’s about recognizing that our financial decisions, big and small, have consequences. By staying informed, being honest with ourselves about our capabilities, and communicating with those we owe, we can steer clear of the default zone and keep our financial lives cruising along, just like a perfect playlist on a long road trip. So, let’s keep those payments on track, our budgets balanced, and our credit reports looking as fresh as a new pair of sneakers!