Polymarket: Supreme Court Tariffs Market, Explained

Picture this: You’re chilling at your favorite café, latte in hand, scrolling through your phone. Suddenly, you stumble upon a website where people are betting actual, hard-earned cash on something so obscure, so wonderfully nerdy, it makes your head spin. We’re not talking about sports scores or the next celebrity baby name. Oh no. We’re talking about the Supreme Court. And tariffs. Yes, you read that right. Welcome to the delightful, slightly deranged world of Polymarket, where the future isn't just observed, it's bet on.

What in the World is Polymarket? And Why Are We Betting on the Supreme Court?

So, what exactly is Polymarket? Imagine if Wall Street, Vegas, and a very informed political science professor had a love child, and that child grew up to build a website. That’s Polymarket. It’s a decentralized prediction market, which sounds terrifyingly techy but basically means people put real money down on whether specific future events will happen. Think of it as a global, real-time wisdom-of-the-crowds experiment, except the crowds have skin in the game. It’s less about picking horses and more about predicting the nuanced outcomes of geopolitical chess matches, scientific breakthroughs, or, in this delightfully bizarre case, high-stakes legal battles.

People create markets for all sorts of wild things: Will aliens be confirmed by 2025? Will a specific obscure politician win their primary? Will AI take over the world by Tuesday? (Okay, maybe not that last one yet.) But what really caught our eye, and has more than a few legal eagles and policy wonks clutching their pearls (or their crypto wallets), is the market predicting the outcome of certain Supreme Court cases, specifically those that could ripple through the very fabric of how our government operates, affecting things like – you guessed it – tariffs.

So, About These Tariffs and the Supreme Court...

Now, let’s peel back the curtain on the specific legal drama unfolding. The Supreme Court has been chewing on a couple of cases, Relentless v. Department of Commerce and Loper Bright Enterprises v. Raimondo, that could absolutely nuke a legal doctrine known as Chevron deference. Sounds like a fancy gas station, right? But it's actually a legal principle from a 1984 case, Chevron U.S.A. Inc. v. Natural Resources Defense Council, Inc. – try saying that five times fast after a few espressos.

In layman's terms, Chevron deference basically says, "Hey, when Congress passes a law that's a bit vague, and a government agency (like, say, the Department of Commerce or the EPA) interprets that law, judges should generally defer to the agency's interpretation, as long as it's reasonable." It’s like your parents telling you to clean your room, but if they don’t specify "no clothes on the floor," and you interpret that as "clothes can be anywhere but inside the closet," they usually have to go with your "reasonable" interpretation. Agencies are the "experts" in their field, so courts generally trust their calls.

But why does this bureaucratic jargon matter to your wallet, and more specifically, to tariffs? Ah, here’s where the plot thickens! Many of the decisions about what gets taxed when it crosses our borders, what percentage, and under what conditions, are made by—you guessed it—these very same government agencies. They interpret complex trade laws passed by Congress. If Chevron deference gets overturned, or significantly weakened, suddenly judges might feel much more empowered to second-guess those agency interpretations. This means a court could look at a tariff decision by, say, the Department of Commerce, and say, "Nope, we think our interpretation of that trade law is better." The power would shift from the executive agencies back to the courts.

The Supreme Court Tariffs Market: A Bet on Bureaucracy (and Your Wallet)

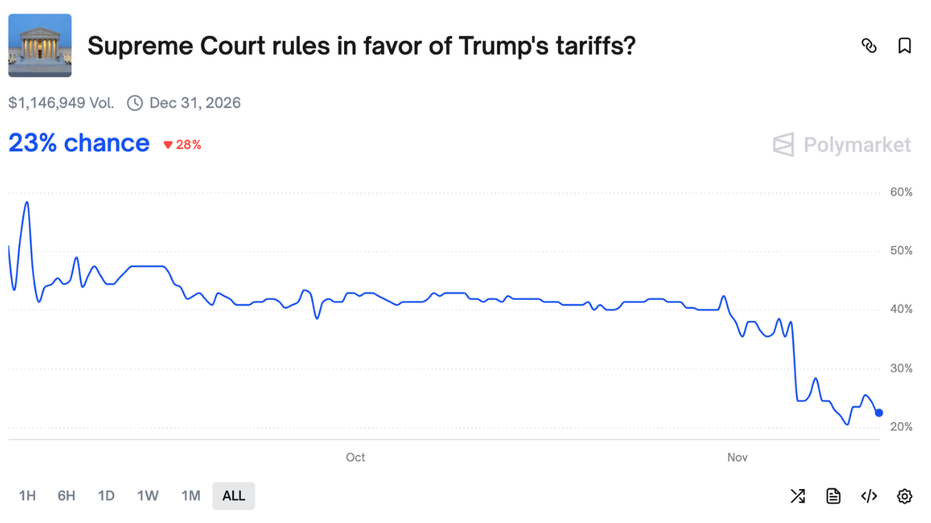

And that, my friends, is why there's a Polymarket for the "Supreme Court Tariffs Market." It’s not a direct "Will the Court impose a new tariff on imported widgets?" bet. Instead, it’s a more nuanced wager on whether the Supreme Court's decisions in these Chevron cases will lead to a significant decrease in agencies’ power to set or adjust tariffs without more direct congressional or judicial oversight. Users are essentially betting on the ripple effect, the butterfly flapping its wings in the Supreme Court and causing a hurricane in the world of international trade policy.

Imagine the stakes! You're not just betting on legal theory; you're betting on the potential cost of your next imported espresso machine, or that fancy foreign cheese. Are you a legal eagle with a crystal ball? Or just someone who fancies themselves a future-predicting financial wizard who also happens to really care about the nuances of administrative law? This market is your playground. People are buying "YES" shares if they think agencies will lose tariff-setting power, and "NO" shares if they think the status quo will largely hold, or if the impact will be negligible.

How Does This Wild West of Prediction Work?

It’s surprisingly straightforward, even if the underlying issues are not. Each market is structured as a binary outcome: "YES" or "NO." You buy shares in your chosen outcome. Let’s say a "YES" share for "Will Chevron’s weakening significantly curb agency tariff power?" is trading at 70 cents. This implies the market believes there's a 70% chance of that happening. If you buy a share at 70 cents and the outcome indeed happens, your share becomes worth $1. Boom! You made 30 cents. If it doesn't happen, your share becomes worth $0. And poof! Your 70 cents are gone.

The beauty of this system is that the prices are constantly fluctuating based on new information, expert opinions, and the collective wisdom (or panic) of the crowd. It’s like a stock market, but instead of companies, you're investing in future realities. It incentivizes people to find and act on good information, because money is on the line. And let's be honest, nothing makes you pay attention quite like the prospect of either winning or losing actual cash.

Why Bother Betting on Legal Lingo?

Beyond the obvious thrill of treating the Supreme Court like a high-stakes poker game, there’s a serious side to prediction markets. Studies have shown they can be surprisingly accurate, often outperforming traditional polls and expert forecasts. Why? Because people are using their own money, they tend to be more thoughtful and less prone to wishful thinking or ideological bias. The market price itself becomes a real-time, aggregated probability of an event occurring, reflecting the combined knowledge of thousands of participants.

It's also an incredibly engaging way to follow complex issues. Who needs dry legal analyses when you can literally invest in your understanding? Suddenly, those arcane Supreme Court oral arguments aren't just for law students; they're vital information for your Polymarket portfolio. You find yourself diving into amici briefs and judicial biographies, not out of academic curiosity, but because your potential winnings depend on it. It transforms passive observation into active, albeit monetized, engagement.

More Than Just Gambling: A Glimpse into the Future?

So, the "Supreme Court Tariffs Market" on Polymarket is more than just a quirky gambling platform. It’s a fascinating socio-economic experiment, a public pulse on complex legal questions, and a testament to the human desire to predict the unpredictable. It offers a unique lens through which to view some of the most intricate and impactful decisions being made in our country, linking the hallowed halls of justice to the very real impact on our economy and, yes, the price of that artisanal imported cheese.

Whether you're an armchair legal scholar, a curious economist, or just someone who enjoys a good speculative bet, Polymarket offers a truly unique experience. It’s weird, it’s wild, and it’s a surprisingly effective way to put your money where your predictions are. So, next time you're sipping that latte, maybe you'll be one of the intrepid souls betting on the future of federal agency power. Just try not to spill your coffee when the Court's opinion drops!