Bad Debts And Provision For Bad Debts

Hey there, coffee buddy! Grab a refill, ’cause we’re diving into something that sounds super boring, but trust me, it’s actually pretty interesting. We’re gonna chat about bad debts and their slightly less dramatic cousin, the provision for bad debts. Think of it like this: sometimes people owe you money, and then… poof! They’re gone. Or maybe they just can’t pay. It happens, right?

So, what exactly IS a bad debt? Imagine you’re a business, maybe selling awesome handmade widgets, or offering super-duper consulting services. You’ve got clients, and some of them owe you cash. Now, if one of those clients really flakes out, like they disappear into the Bermuda Triangle of unpaid invoices, or their business goes belly-up faster than a deflated balloon at a toddler’s birthday party, that’s a bad debt. It’s money you were expecting, money you probably needed, and now… well, it's gone. Kaput. Finito.

It’s basically a financial ghost. You’ve sent the invoices, you’ve chased them down, maybe even sent a sternly worded email with a 😉 emoji (because, you know, professionalism!), but nada. Zilch. That money? It's officially not coming. And that, my friend, stings. It’s like when you buy that amazing outfit online, and it arrives looking nothing like the picture. Disappointment city, population: you.

Businesses, bless their hearts, have to deal with this all the time. It’s the risk of doing business, I guess. You can’t be so scared of someone not paying that you never sell anything, can you? That would be like never going on a date because you’re afraid of getting stood up. Scary, but you might miss out on some amazing people!

So, when a debt is officially declared bad, it’s a real loss for the company. It affects their profits, their cash flow, and probably their mood. Imagine the accountant, staring at the numbers, muttering, "Another one bites the dust." It's not exactly a party atmosphere. They might even shed a single, dramatic tear into their spreadsheet.

But here’s where it gets a little more strategic. Instead of just waiting for the bad debt fairy to swoop in and magically make debts disappear (spoiler alert: she doesn't exist, much to my disappointment), businesses get smart. They start thinking ahead. They’re like, "Hmm, based on past experiences, it's likely that some of the money owed to us is never going to materialize. It's a sad truth, but it's true."

And that, my friend, is where the provision for bad debts comes in. Think of it as a tiny, tiny financial safety net. It’s not a magical shield that prevents bad debts, but it’s more like an umbrella for a light drizzle. You’re not expecting a hurricane, but a little bit of rain? Yeah, better be prepared.

A provision for bad debts is essentially an estimate. It's the business saying, "Okay, out of all the money our customers owe us right now, we’re going to set aside a little chunk, just in case some of it turns out to be uncollectible." It’s like putting a little bit of money aside for a rainy day, but instead of a rainy day, it’s a “client went AWOL” day.

It’s a really smart move, actually. Why? Because it makes their financial statements look way more realistic. Instead of showing all the money they think they’re owed, they show what they realistically expect to collect. This is super important for anyone looking at the company’s finances, whether it’s investors, lenders, or even the tax man (who, let's be honest, loves a clear picture).

So, how do they figure out this magic number, this estimated amount? It’s not like they pull it out of a hat. There are methods, you know. They might look at their past history. For example, if historically 2% of their invoices never get paid, they might apply that 2% to their current outstanding debts. It’s like saying, "Well, last year, about this many people forgot to pay, so let's plan for that again."

They also might consider specific clients. Is there that one client who’s always late with payments? Maybe they’re a bit of a credit risk. The business might then adjust their provision based on how risky individual customers seem. It’s like being a detective for your own money!

Another way is through aging of receivables. This sounds fancy, but it’s just looking at how long debts have been outstanding. If an invoice is 30 days old, it’s probably fine. If it’s 300 days old? Uh oh. That one's starting to look like it’s doing yoga in the land of forgotten payments. The older a debt gets, the less likely it is to be paid, so the provision for those older debts might be higher. Makes sense, right?

Now, here’s a key distinction that trips some people up: bad debt is the actual loss when you realize you’re not getting paid. It’s the moment of truth, the “oh no” moment. The provision for bad debts is the anticipation of that loss. It's the proactive step, the "let's prepare for the worst, hope for the best" strategy.

Think of it like this: you're packing for a trip. A bad debt is like realizing you forgot your toothbrush once you get to the hotel. Annoying, right? A provision for bad debts is like packing an extra toothbrush just in case you lose one, or realizing you packed too many socks and deciding to leave a couple behind to make space for souvenirs. See the difference? One is a problem that happened, the other is planning to prevent or mitigate a potential problem.

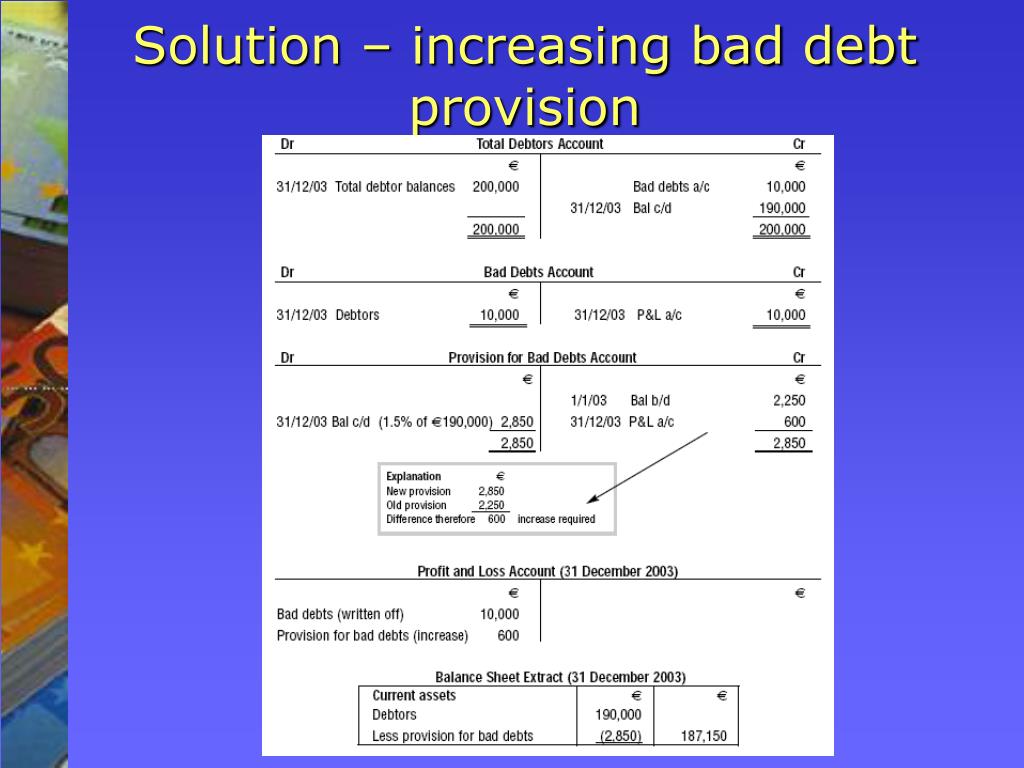

On the financial statements, this is where it gets a bit technical. When a business creates a provision for bad debts, it's usually recorded as an expense. This is called a bad debt expense. So, even though no specific customer has yet defaulted, the company is recognizing that some of their revenue might not be collected. It reduces their reported profit for that period. It’s like saying, "Okay, we made this much money, but we know some of it is going to evaporate, so let’s account for that now."

Then, when a specific debt does become a bad debt, it’s written off against this provision. So, instead of hitting the profit and loss statement directly for the full amount of the now-uncollectible debt, it’s used up from the provision that was already created. It's like dipping into your savings account to cover an unexpected bill. The money is already accounted for, so it doesn't cause a sudden shock to your finances.

This whole process is super important for making sure a company's financial health is reported accurately. If a company didn't account for potential bad debts, their profits would look artificially high. Investors might be fooled into thinking the company is doing better than it actually is. And that, my friends, is a recipe for disaster. Remember that old saying, "Hope for the best, but plan for the worst"? Well, this is the financial version of that!

So, to recap, a bad debt is a real, confirmed loss of money owed to you. It’s the ghost in the machine. The provision for bad debts is the smart, forward-thinking act of setting aside an estimated amount to cover those potential future losses. It's the company’s way of saying, "We're not naive; we know things happen."

It’s like with our coffee here. Let's say you’re out with a friend, and they’re always a bit forgetful. You might buy them a coffee, but you also mentally prepare for the possibility that they might forget their wallet and you’ll have to cover it. That mental preparation? That’s your little provision for bad debts in action. The actual moment you have to pay for their coffee because they’re digging through their bag for a wallet that isn't there? That’s the bad debt event.

Why is this so important for businesses? Well, besides the accuracy thing we talked about, it helps with budgeting. If you know you’re likely to lose a certain percentage of your sales to non-payment, you can factor that into your pricing and your overall financial planning. You won’t be caught completely off guard when those debts inevitably go south.

It also impacts how a company is valued. If a company has a huge chunk of its accounts receivable that are really old and unlikely to be paid, that’s a red flag. It suggests poor credit management or a struggling customer base. The provision helps to reflect that reality, making the company’s balance sheet a truer picture of its financial standing.

Think of it like a doctor checking your vitals. A bad debt is like finding out you have a fever – a clear problem. The provision for bad debts is like a doctor recommending you get plenty of rest and fluids before you get sick, based on your lifestyle and other risk factors. It’s preventative medicine for your finances!

And let’s not forget the tax implications. The bad debt expense recorded when a provision is made, or when a debt is written off, is usually tax-deductible. This means it can reduce the amount of tax a company has to pay. So, while it’s a loss of revenue, there’s a silver lining for the tax man. Every cloud, right?

The really tricky part, of course, is estimating that provision accurately. Too high, and you’re being overly pessimistic, reducing your profits more than necessary. Too low, and you’re being too optimistic, and you’ll get a nasty surprise when those debts actually go bad. It’s a constant balancing act, a bit like trying to find the perfect temperature for your coffee – just right!

So, there you have it! Bad debts and provisions for bad debts. They might sound like dry accounting jargon, but they’re really about managing risk, being realistic, and keeping a business’s finances in good shape. It’s about acknowledging that while sales are great, getting paid for those sales is even better, and sometimes, that doesn’t quite happen. And that's okay, as long as you're prepared!

Next time you’re sipping your coffee and contemplating the mysteries of the universe, you can also ponder the fascinating world of uncollectible invoices. Who knew accounting could be so… adventurous? Thanks for chatting, it’s been fun!