Average Credit Limit On A Credit Card

Hey there, savvy spenders and aspiring budget wizards! Ever find yourself scrolling through your banking app, or maybe you're about to apply for your very first credit card, and that little question pops into your head: "So, what's the average credit limit, anyway?" It’s a totally valid curiosity, right? Like wondering what the average person's Netflix binge session looks like, or how many sourdough starters are currently bubbling away across the nation. It’s one of those everyday money mysteries that doesn’t need a deep dive into complex financial jargon. We’re talking easy-breezy, feel-good financial facts here, so let’s unpack this without breaking a sweat.

Think of your credit limit as your personal spending runway. It’s the maximum amount a credit card issuer is willing to let you borrow on that specific card. It’s not a target to hit, but rather a guideline. And just like your taste in music or your favorite pizza topping, credit limits are incredibly diverse. There's no single magic number that fits everyone. It’s a bit like asking, "What's the average height of a plant?" – it depends on whether you're talking about a succulent on your windowsill or a giant redwood!

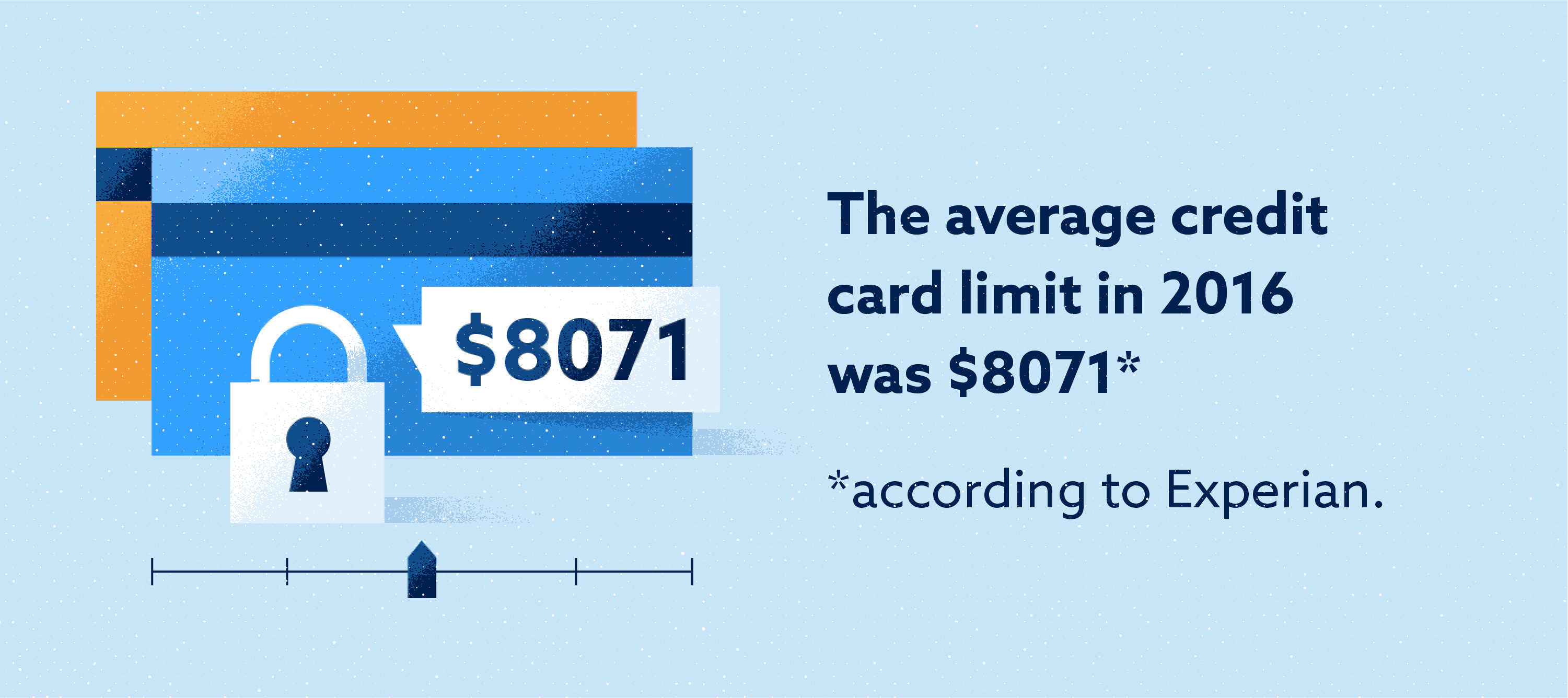

So, what’s the deal with this "average" figure? Well, financial institutions and credit bureaus often crunch the numbers, and you'll see figures floating around that suggest the average credit limit can range anywhere from around $1,000 to $10,000. But here’s the kicker: that’s a really broad range, and it’s influenced by a whole cocktail of factors. It’s not a definitive score, but more of a general ballpark.

The Secret Sauce Behind Your Credit Limit

Why such a wide spread? It all comes down to a few key ingredients that lenders consider when they're deciding how much credit to extend to you. They're essentially doing a little bit of risk assessment, like a movie producer deciding who gets the starring role based on their track record.

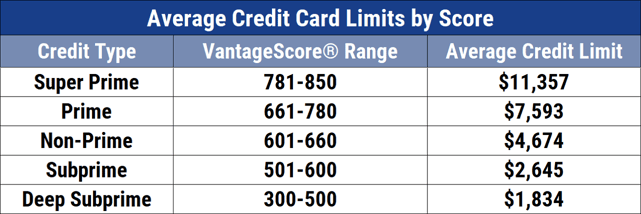

First up is your credit score. This is your financial report card, a three-digit number that tells lenders how reliably you've managed credit in the past. A higher credit score generally means you're a lower risk, which often translates to a higher credit limit. Think of it as graduating from the kiddie pool to the Olympic diving board – you’ve proven you can handle the big stuff.

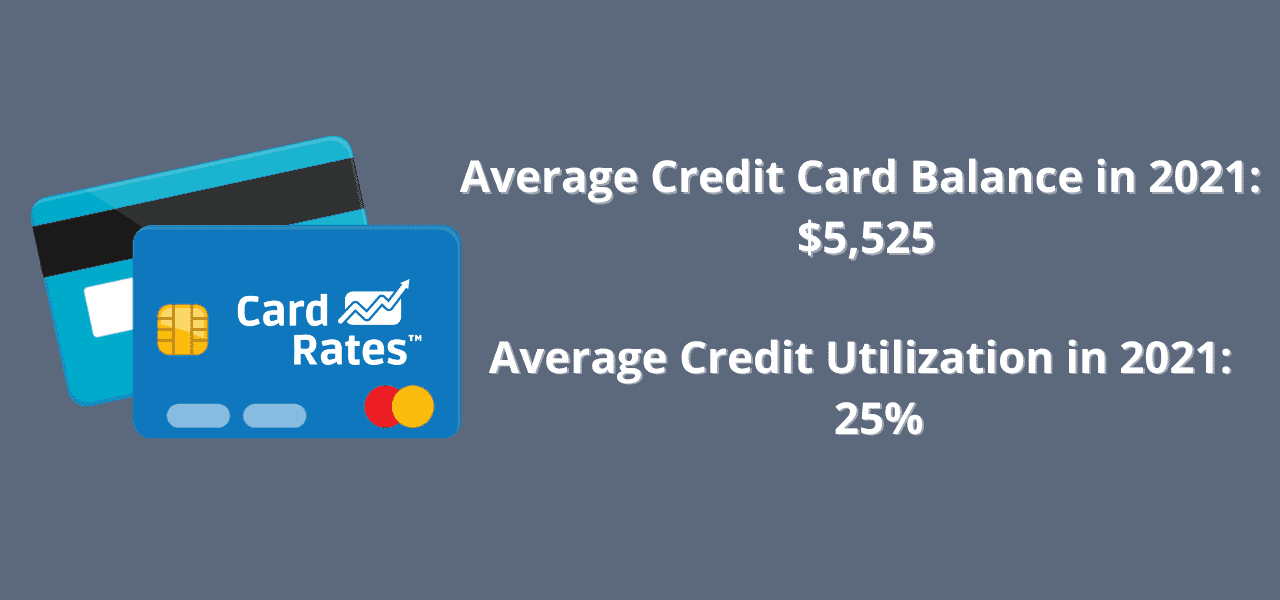

Then there's your credit history. This is the detailed breakdown of your credit score – how long you've had credit, what types of credit you've used (credit cards, loans, mortgages), how often you've paid on time, and how much of your available credit you typically use. A long and spotless history is like a well-worn passport, showing you've traveled the world of credit responsibly.

Your income plays a starring role too. Lenders want to ensure you have the means to repay what you borrow. If you have a healthy income, it suggests you can comfortably handle a larger credit limit. It’s like ordering a large latte when you’re feeling extra caffeinated – you know you can handle it!

:max_bytes(150000):strip_icc()/howtoincreaseyourlimitonyourfirstcreditcard-07d537491b0648cdbc51438989360ca8.png)

The type of credit card you're applying for also makes a difference. Premium travel cards with fancy perks often come with higher credit limits than basic student or secured cards. It's like choosing between a designer handbag and a canvas tote – one generally comes with a higher price tag (and limit!).

Finally, there's the relationship you have with the issuer. If you've been a loyal customer with a bank for years, holding checking accounts and savings accounts with them, they might be more inclined to offer you a higher limit. They know you, they trust you, and that’s worth something!

What Does This "Average" Really Mean for You?

Okay, so we've talked about the "average" and the factors influencing it. But let's bring it back to you and your personal finance journey. The average credit limit is really just a benchmark, a way to understand the broader landscape. It's not something you should obsess over or feel pressured to match.

For someone just starting out, perhaps with their first student credit card, a credit limit of $500 to $1,000 might be perfectly normal. And guess what? That’s fantastic! It’s about building good credit habits, not about having the highest limit in the room. It's like learning to ride a bike – you start with training wheels and eventually, you're cruising down the street.

For those with a solid credit history and a decent income, limits can climb significantly, sometimes reaching $5,000 to $10,000 or even more. And for the credit card connoisseurs out there with impeccable financial records and high incomes, limits of $20,000, $50,000, or even six figures aren't unheard of. These are the folks who might be collecting ultra-premium rewards or using their cards for large purchases and then paying them off in full – think of it as a sophisticated financial ballet.

The key takeaway here is that your credit limit should be appropriate for your lifestyle and your spending habits. It's not about chasing the highest number. A limit that's too high can be tempting, potentially leading to overspending if you're not careful. Conversely, a limit that's too low might feel restrictive if you're looking to make a larger purchase or take advantage of a special offer.

Navigating Your Own Credit Limit Adventure

So, how do you ensure your credit limit is just right for you? It’s all about smart strategy and a touch of self-awareness.

1. Start Smart: If you're new to credit, focus on getting a card with reasonable terms and build a strong payment history. Don’t aim for the stars on day one. A secured card or a student card can be excellent stepping stones. Think of it like choosing your first video game – start with something accessible and fun!

2. Know Your Worth (Financially Speaking): When you apply for a card, be realistic about your income and your ability to repay. Lenders often have pre-qualification tools that can give you an idea of what you might be approved for without impacting your credit score. It's like looking at the menu before ordering your meal.

3. Watch Your Credit Score Like a Hawk (a Friendly Hawk): Regularly check your credit score. There are many free services that allow you to do this. Understanding where you stand is crucial for knowing what credit limits you might qualify for and for identifying any potential issues. It's like checking the weather forecast before planning your picnic.

4. Build and Grow: As you use your credit card responsibly – meaning you pay your bills on time and keep your credit utilization low – your credit limit can naturally increase over time. Many issuers will automatically review your account and offer a credit line increase. You can also proactively request one after a period of good behavior.

5. Ask Nicely: Don't be afraid to ask your credit card issuer for a credit limit increase if you believe you qualify. A polite request, backed by a history of responsible credit use, can often yield positive results. It’s like asking for an extra scoop of ice cream – a little charm goes a long way!

6. Avoid the Temptation Trap: A higher credit limit isn’t an invitation to spend more than you can afford. It’s a tool that, when used wisely, can offer flexibility, help with larger purchases, and even improve your credit utilization ratio (which is a good thing!). Imagine getting a bigger toolbox – it doesn’t mean you have to build a mansion, but it gives you more options for your projects.

Fun Facts and Financial Folklore

Did you know that the concept of credit dates back thousands of years? Ancient civilizations used rudimentary forms of credit, like bartering and promissory notes. So, your credit card is essentially the modern-day descendant of lending a helping hand (or a handful of grain!) to your neighbor.

The term "credit limit" itself is pretty straightforward, but the credit scores we rely on today, like FICO scores, were developed in the 1950s. It's amazing how far we've come from IOUs scribbled on parchment to sophisticated algorithms analyzing our financial habits!

And here’s a quirky one: some credit card companies offer incredibly high credit limits to their most valued customers, sometimes reaching up to $100,000 or even more. These are often reserved for high-net-worth individuals and come with exclusive perks. Think of it as a VIP pass to the financial world, complete with a velvet rope and a personal concierge.

A Little Reflection for Your Pocket

Ultimately, understanding the average credit limit is less about comparing yourself to others and more about empowering yourself with knowledge. It’s about recognizing that your credit limit is a dynamic figure, shaped by your financial journey and your relationship with lenders.

In the grand scheme of life, the exact number on your credit card statement might not be the most thrilling topic, but it’s undeniably a piece of the puzzle that helps us navigate our daily lives. It allows us to make those impulse purchases (responsibly, of course!), plan for bigger life events like a new couch or a much-needed vacation, and build a foundation of financial responsibility.

So, next time you see that credit limit, whether it’s modest or mighty, remember it’s a reflection of your financial story. And like any good story, it’s one you’re actively writing, chapter by chapter, payment by payment. Embrace your limit, use it wisely, and keep on building that awesome financial future. It’s all about living your best, most financially savvy life, one credit swipe (and payment) at a time!